How can accounting firms harness the power of online reviews and testimonials?

Introduction:

Accounting firms today are discovering a powerful ally in online reviews and testimonials. Yet, many are still not fully embracing this potent tool. This blog post is about changing that. It's about understanding how positive client feedback, far from casual comments, can transform your business. We'll explore practical strategies to encourage clients to share their experiences and ways to effectively showcase these endorsements, thereby enhancing your firm's appeal to new clients.

Learn how to turn positive reviews into a strategic asset that bolsters your firm’s online presence and acts as a beacon, guiding potential clients to your doorstep. Through this blog, you’ll gain actionable insights to harness the full potential of client testimonials, making them a cornerstone of your firm's growth strategy.

Key takeaways

Online reviews critically influence potential clients' decisions in choosing accounting firms.

Direct client engagement, such as personal conversations, is highly effective in requesting reviews.

Client testimonials serve as potent social proof, influencing others' choices by showcasing real client experiences.

Strategically presenting testimonials across various marketing channels maximises their impact and reach.

The importance of online reviews

Online reviews are critically important for accounting firms, as they significantly influence potential clients' decision-making. Much like reviews guide choices for movies or restaurants, they play a similar role for accounting firms. Positive reviews are vital in establishing and enhancing a firm's local reputation, making it a recommended choice for accounting services within the community. Furthermore, having an active presence on online review platforms through registration and optimised listings ensures greater visibility and credibility.

A lack of online reviews can create a negative perception, suggesting risk or inexperience. Therefore, it's essential for accounting firms to proactively seek positive reviews, as they not only build trust and transparency with clients but also contribute to growth and client satisfaction. Engaging in effective reputation management through client feedback and reviews is an indispensable strategy for accounting firms aiming to thrive in a competitive market.

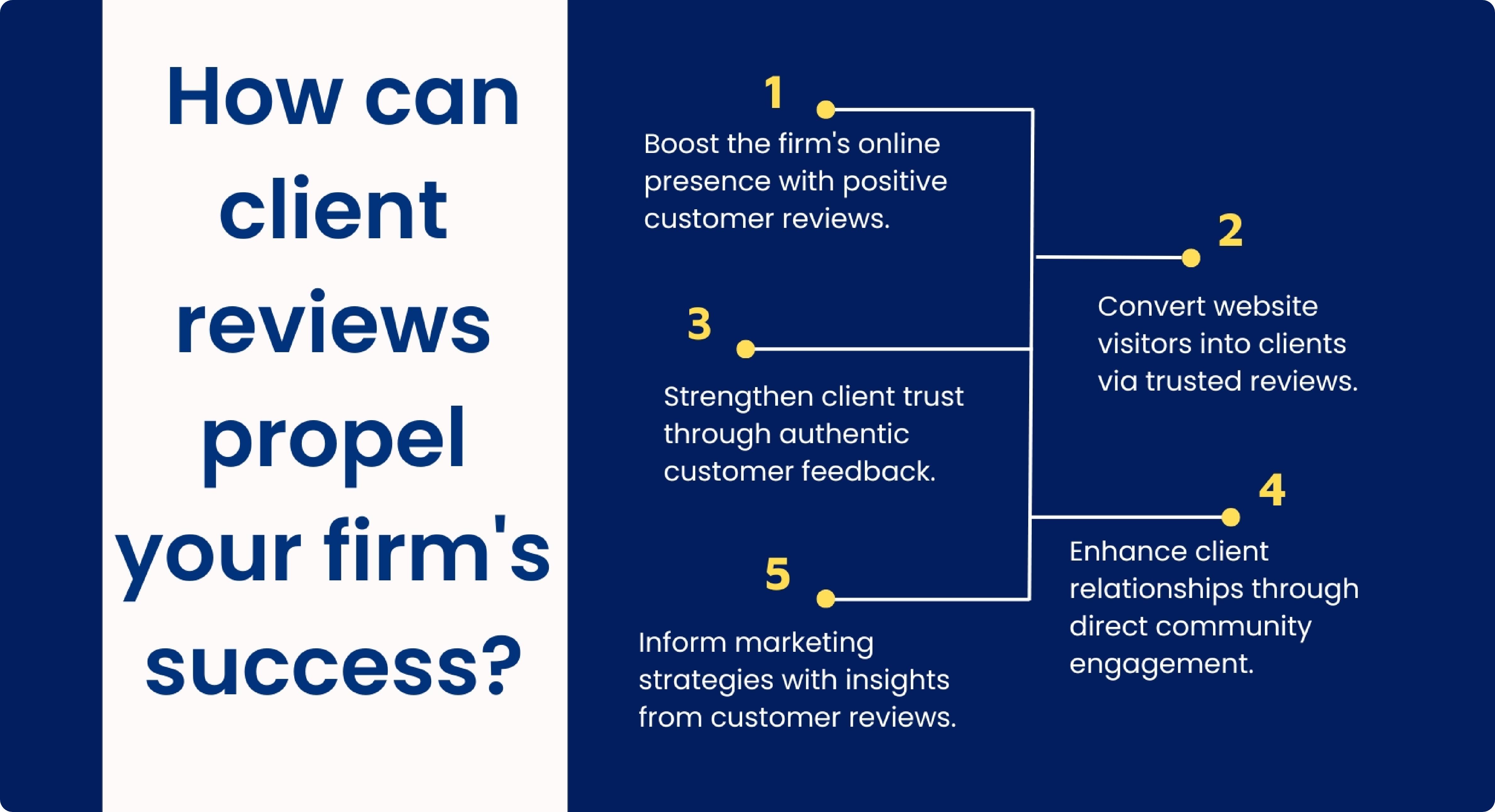

How can client reviews propel your firm's success?

Client reviews are pivotal for accounting firms aiming to thrive in a competitive market. They not only enhance reputation but also provide critical insights for business growth. Here's how they can make a difference:

Techniques for accounting firms to gather online reviews

Here are a few techniques accounting firms can leverage to collect online reviews:

-

Direct client engagement:

Personal interaction remains one of the most effective ways to request reviews. Engaging with clients directly after completing a project and explaining the importance of their feedback in person can significantly increase the likelihood of receiving reviews. Firms can guide clients on how to leave reviews by indicating preferred platforms like Google Reviews or Facebook and providing convenient methods such as QR codes. Physical reminders in the office, like signs with QR codes, can also prompt clients to leave reviews.

-

Email campaigns:

Emails are a tried and tested medium for communication and can be effectively used to request reviews. The key to a successful email campaign is to keep messages brief, polite, and to the point, ideally sent shortly after the completion of a service. Personalising emails and providing a direct link to the review page simplifies the process for clients and increases the chances of receiving feedback.

-

Text messaging:

Utilising text messages for review requests can be highly effective due to their high open rates. However, ensuring that clients have opted in to receive texts is essential. A streamlined process using SMS chat widgets or keyword prompts can facilitate this interaction, making it easier for clients to leave reviews.

-

Social media outreach:

Social media platforms offer a dynamic way to request reviews. Engaging posts and graphics on platforms like LinkedIn and Facebook can prompt clients to leave feedback. Showcasing client testimonials on these platforms can also encourage others to share their experiences.

-

Responding to reviews:

Actively responding to all reviews, positive or negative, demonstrates a firm’s commitment to its clients. Thoughtful and empathetic responses to feedback can significantly impact the firm’s reputation and encourage more clients to share their experiences.

Why do client testimonials matter?

Client testimonials are a cornerstone in building the trust and credibility of an accounting firm. They serve as potent social proof, a psychological and social phenomenon where the experiences and recommendations of others influence people's actions. In the accounting sector, where trustworthiness and dependability are paramount, testimonials from content clients can significantly sway potential clients' decision-making. They endorse the quality of service and provide a personal, relatable narrative that potential clients can connect with.

This sense of reassurance and validation is invaluable, as it helps new clients feel more confident in their choice to engage with the firm. Testimonials thus become a vital component in the firm’s marketing strategy, directly impacting its ability to attract and retain clientele. They are more than mere reviews; they are narratives that reinforce the firm's reputation and showcase its ability to meet and exceed client expectations.

Stategies to acquire client testimonials

Acquiring client testimonials is a strategic process that requires thoughtful planning and execution. For accounting firms, these testimonials are not just feedback; they are endorsements of their service quality and client satisfaction.

Implementing a systematic approach to collecting these testimonials is vital. It involves understanding client experiences, personalising outreach, and guiding clients in providing valuable insights. The following strategies offer a roadmap for accounting firms to effectively gather these crucial endorsements, enhancing their reputation and building trust among potential clients.

-

Identify satisfied clients:

Begin by pinpointing a group of contented clients. Their positive experiences make them ideal candidates for providing impactful testimonials.

-

Personal outreach:

Reach out to these clients personally. A direct approach is often more effective and can lead to more genuine testimonials.

-

Guidance on testimonial content:

Provide clients with guidance on what kind of information would be most helpful in their testimonials. This could include specific aspects of your service that they found beneficial.

-

Ask service-related questions:

Frame your request around specific service aspects to elicit detailed and relevant responses.

-

Assess satisfaction level:

Before asking for testimonials, gauge the client's level of satisfaction. This can be done through surveys or direct conversations, ensuring that the feedback you receive is both positive and authentic.

-

Make the process easy:

Provide a straightforward method for clients to submit their testimonials, whether through a form on your website, via email, or through a direct link.

-

Follow-up:

If necessary, follow up with clients willing to provide a testimonial but haven't yet done so.

-

Express gratitude:

Always thank your clients for their time and feedback, regardless of whether they decide to provide a testimonial. This helps maintain a positive relationship and opens the door for future cooperation.

Best practices for client testimonials

Once you have collected client testimonials, it’s essential to follow best practices to ensure that they are effective. Here are some best practices for client testimonials:

How can testimonials maximise their impact?

To maximise the impact of client testimonials, they must be presented authentically and engagingly. A testimonial's power lies in its ability to resonate with potential clients. So, including specific details like the client's name, business, and unique experience with the firm adds credibility and a personal touch.

Choosing testimonials that narrate a client's journey – the challenges they faced and how the firm's expertise helped overcome them – can be particularly compelling. These stories illustrate the firm's problem-solving abilities and client-centric approach.

Incorporating these testimonials across various marketing platforms, such as the firm's website, brochures, and social media, ensures a broad reach. Also, embracing diverse formats like audio or video testimonials can capture the audience's attention more effectively and provide a more immersive experience. By showcasing these real-life success stories, accounting firms can significantly bolster their reputation and appeal to a broader client base.

Conclusion

The importance of online reviews and testimonials for accounting firms aiming to enhance their market presence and client trust cannot be overstated. These digital tools can lead to remarkable growth and improved credibility when used effectively. For firms looking to streamline their operations further, turning to Accxpert's reliable outsourcing accounting services is a strategic choice.

Accxpert offers expertise in managing accounting tasks efficiently, freeing firms to focus more on strategic client engagement and reputation management. Contact us for more information on how Accxpert can support your firm's success. Our dedicated team is ready to offer solutions that align with your needs, fostering efficiency and growth.