The role of accounting firms in helping debt management and recovery for their clients

Introduction:

Debt management and recovery are more than just financial terms; they are critical lifelines for businesses navigating the turbulent waters of today's economy. As these challenges become increasingly complex, the role of accounting firms has evolved and expanded.

No longer just the guardians of financial records, these firms have become strategic partners, offering invaluable insights and tailored solutions to clients facing debt dilemmas.

Their expertise in analysing, advising, and implementing effective debt management strategies positions them as essential allies in the quest for financial stability.

This blog aims to delve deeper into the multifaceted role of accounting firms, highlighting their indispensable contribution to successful debt management and recovery for their clients.

Key takeaways

Accounting firms are now strategic allies in guiding businesses through debt management and recovery.

Several challenges, from manpower shortages to cultural barriers, hinder effective debt management.

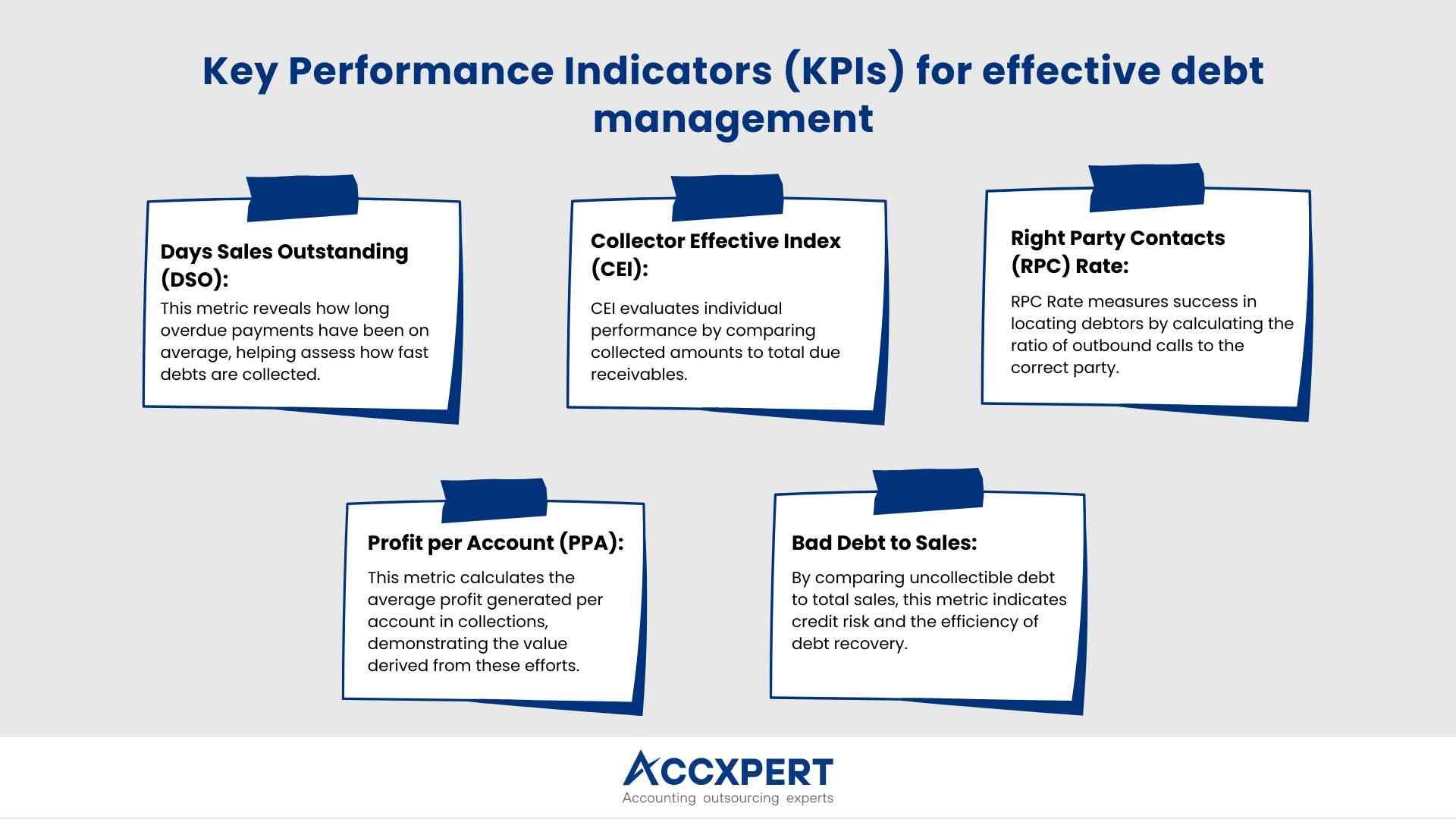

Metrics like Days Sales Outstanding, Collector Effective Index, Right Party Contacts Rate, and others are essential for evaluating debt management effectiveness.

Modern technology, such as AI and automation, is transforming the debt management service offered by accounting firms.

Definition and importance of debt management

Debt management refers to the strategic approach employed by businesses or individuals to control, reduce, and manage their debt. It encompasses a range of activities, from negotiating with creditors for lower interest rates to consolidating multiple debts into one manageable monthly payment.

The primary objective is to minimise outstanding obligations, regain control over finances, and ensure long-term financial stability. Effective debt management is crucial as it prevents potential financial pitfalls, reduces the burden of overwhelming debt, and paves the way for financial freedom.

How accounting principles lay the foundation for effective debt management?

Accounting principles, often encapsulated within the Australian Accounting Standards, are the backbone of any robust financial system. Their role in debt management is pivotal, ensuring that businesses maintain fiscal health and make informed financial decisions.

The principles given below elucidate their significance:

-

Accrual and matching principles:

These principles emphasise the importance of recognising financial events when they occur, not when the cash transaction happens. By doing so, businesses can identify debts early, allowing for timely interventions and effective management strategies.

-

Conservatism principle:

A cautious approach ensures that businesses are prepared for potential financial setbacks. By recognizing potential losses and liabilities early, companies can strategize proactively, ensuring they remain in a strong position to manage and repay debts.

-

Full disclosure principle:

Transparency is key in financial reporting. By fully disclosing all financial information, businesses can foster trust with stakeholders, including creditors. This open communication can lead to better terms during debt negotiations and refinancing efforts.

-

Economic entity principle:

By keeping business transactions separate from personal ones, companies ensure clarity in their financial records. This clear delineation aids in precise debt tracking and management.

-

Monetary unit principle:

Recording transactions in a consistent currency without adjusting for inflation ensures uniformity in financial records. This consistency is crucial for understanding the true scale of debts and formulating repayment strategies.

-

Going concern principle:

This principle operates on the assumption that a business will continue its operations in the foreseeable future. It encourages long-term planning, allowing businesses to structure their debts in a way that's sustainable and aligned with their future growth trajectories.

What are the predominant challenges businesses face in debt management and recovery?

For businesses, ensuring they're paid on time is vital. Yet, the path to successful debt management and recovery is often strewn with obstacles. Whether it's the intricacies of regulations, the nuances of communication, or the unpredictability of the global economy, businesses grapple with a myriad of challenges. Here's a deeper dive into these issues:

-

Not enough people:

Small businesses might not have a team just for collecting money. This means a few people have to do many jobs, including trying to get back owed money. This can lead to mistakes or missed chances to collect debts.

-

Confusing rules:

There are many laws about collecting money. These laws can change based on where the business is. It's hard for businesses to always know and follow these rules, and mistakes can lead to legal problems.

-

Language and culture issues:

Businesses deal with customers from different backgrounds. This can lead to misunderstandings because of language differences or different ways of doing business. These misunderstandings can make it harder to collect money.

-

Worry about image:

Businesses need to be careful when asking for money. They don't want to upset customers or get a bad name. This means they have to find a way to ask for money firmly but politely.

-

Tech problems:

There are many tools that can help with collecting debts. But not all businesses know about them or how to use them. This means they might miss out on easier ways to manage and collect debts.

-

Changing money situations:

The world's economy can change quickly. Things like global events can affect how much money people and businesses have. This can make it hard for businesses to predict if and when they'll get paid.

How do accounting firms navigate debt management for businesses?

Accounting firms are instrumental in guiding businesses through the complexities of financial health, especially in the realm of debt management and recovery. Here's a breakdown of the multifaceted strategies accounting firms employ:

-

Comprehensive financial analysis:

One of the primary roles of accounting firms is to provide a clear picture of a business's financial health. They delve deep into balance sheets, income statements, and cash flow statements to pinpoint areas of concern, especially regarding debts. By understanding where a business stands, they can offer tailored advice on managing liabilities.

-

Budgeting and cash flow management:

Proper budgeting is the backbone of effective debt management. Accounting firms assist businesses in crafting budgets that align with their financial goals. They also emphasise the importance of cash flow, ensuring that businesses have enough liquidity to meet their short-term obligations, including debt repayments.

-

Debt prioritisation and structuring:

Not all debts are the same. Some carry higher interest rates, while others might have more stringent terms. Accounting firms help businesses categorise and prioritise their debts, ensuring that the most pressing liabilities are addressed first. This structured approach can save businesses money in the long run.

-

Tax implications and debt:

Debts, especially business loans, have tax implications. Accounting firms guide businesses on how to navigate these, ensuring that all tax benefits related to interest payments and debt financing are utilised. This can significantly impact a company's net profitability.

-

Risk management and financial forecasting:

Predicting future financial challenges is crucial for effective debt management. Accounting firms use financial forecasting to anticipate potential cash flow issues, helping businesses prepare in advance. They also advise on risk management strategies to mitigate the impact of unforeseen financial setbacks.

How are accounting firms leveraging technology for enhanced debt management?

In the evolving digital landscape, technology is playing a pivotal role in reshaping the methodologies and processes of various industries. For accounting firms, technology offers a suite of tools and platforms that streamline their services, especially in the realm of debt management for their clients.

-

Automation in debt tracking and reporting:

Automation tools have revolutionised the way accounting firms track and report debts of their clients. Instead of manually sifting through ledgers and spreadsheets, firms can now use software that automatically updates debt records, sends reminders for upcoming payments, and generates comprehensive reports. This not only reduces human error but also ensures timely interventions.

-

Data analytics for informed decision making:

Advanced data analytics tools provide accounting firms with deep insights into their clients' financial behaviours. By analysing payment histories, spending patterns, and other financial data, firms can offer tailored advice on debt management strategies. This data-driven approach ensures that clients receive actionable insights tailored to their unique financial situations.

-

Enhanced client communication platforms:

Digital communication tools, such as client portals, chatbots, and integrated messaging systems, have transformed the way accounting firms interact with their clients. These platforms facilitate real-time communication, allowing firms to address client queries promptly, share important updates, and provide timely advice on debt-related matters.

-

Secure cloud-based solutions:

Cloud-based accounting platforms offer secure and accessible solutions for debt management. Clients can log in from anywhere to view their financial statements, track their debts, and collaborate with their accountants in real-time. This ensures transparency and fosters trust between the firm and its clients.

-

AI-driven forecasting for debt management:

Artificial Intelligence (AI) algorithms can predict potential financial challenges, helping clients prepare in advance. By analysing past data and current financial trends, AI-driven tools can forecast cash flow issues, enabling clients to make informed decisions about debt repayment and financial planning.

-

Integration with payment gateways:

Modern accounting software integrates seamlessly with various payment gateways, making it easier for clients to manage and settle their debts. Automated payment reminders, easy payment options, and instant payment confirmations ensure that clients stay on top of their debt obligations.

-

Real-time dashboards for instant insights:

Interactive dashboards provide clients with a real-time overview of their financial health. By visualising their debt positions, outstanding amounts, and repayment schedules, clients can gain a clear understanding of their financial standing.

-

Compliance and regulatory adherence:

With ever-evolving financial regulations, accounting firms need to ensure that their debt management practices adhere to industry standards. Technology offers tools that automatically update based on regulatory changes, ensuring that firms and their clients remain compliant at all times.

Curious about the role of technology in outsourcing?

Explore the opportunities and challenges technology brings to accounting with our ebook.

How outsourcing accounting service to Accxpert can elevate your debt management services?

Outsourcing to Accxpert can be a game-changer for accounting firms aiming to enhance their debt management services. As an esteemed accounting service provider, Accxpert specialises in offering advanced debt management solutions tailored for the unique challenges faced by accounting firms.

Our team of experts employs cutting-edge technology to streamline debt tracking, analysis, and strategy formulation. This ensures that accounting firms can offer their clients a more efficient and effective approach to managing financial obligations.

Accxpert's commitment to transparency and communication means that partnering accounting firms are always in the loop. We provide detailed reports, enabling firms to offer their clients a clear view of their debt positions, actionable insights, and recovery strategies.

Moreover, our deep understanding of the Australian market equips us to guide accounting firms on regulatory and compliance aspects related to debt. This ensures that your firm not only delivers top-notch debt management services but also stays ahead in terms of compliance and industry best practices.

Conclusion

When it comes to debt management, accounting firms go a long way in helping their clients effectively track and manage debts. Understanding the basics of debt management and its principles are vital in ensuring recovery and success for clients. Accounting firms often have to deal with challenges such as slow debtor payments or miscalculation of credits.

Technology has revolutionised the way accounting firms handle debt management by generating accurate reports as well as providing better client support. Outsourcing accounting services like Accxpert can be great solutions for elevating debt management and providing better results for both accountants and their clients.

At Accxpert, we recognise the importance of proper financial analysis and structural operations that get clients on the right track. We provide the necessary resources to simplify tasks and eliminate worrying about mistakes. Contact us today to learn more about how we help our clients take control of their finances!